Blog

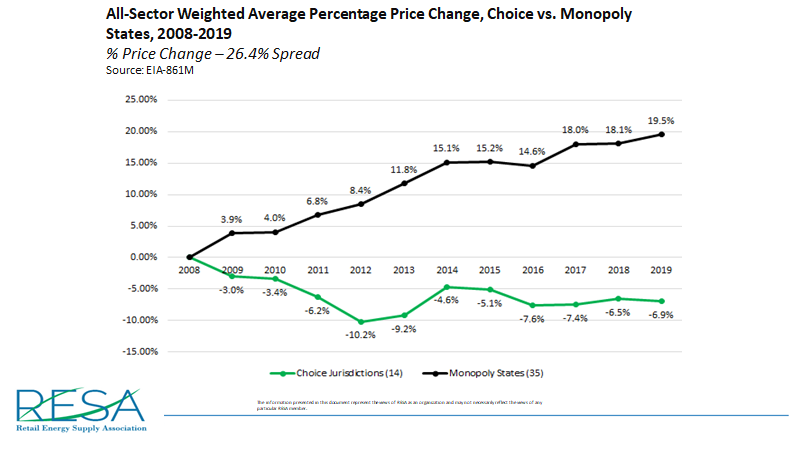

Competitive Energy Markets work for consumers! Here is the proof

Net Metering comes back to Ameren

The Illinois Commerce Commission has agreed with solar advocates that faulty math should not determine which residential solar customers in the state receive retail-rate net metering – the compensation residential solar owners receive for the surplus power they put back on the grid.

In a Dec. 2 decision, the commission rejected investor-owned utility Ameren Illinois’ calculation of a 5% threshold, which, the utility claimed, allowed it to switch new residential solar customers from retail-rate net metering to significantly lower “location-based distribution rebates.”

Illinois Clean Energy Initiatives

Between Prtizker and Biden administrations, policy will probably force you to either to participate in solar or pay hefty carbon taxes. Read this paper.

Climate Change and Investment Strategies

Investing in fossil fuel companies today is like investing in tobacco companies back in the 1990s. Corporate renewable energy and sustainability initiatives are important beyond dollars and cents….

Here is just one example, but a big one!

Nicor Rate Case – Updated Schedule

This rate case continues to move forward. Nicor propsed it as revenue neutral to consumers. However, it will impact the efficiency of the Chicago natural gas market, it will kill liquidity and create extreme price swings, both will hurt the consumer….

Still not too late to intervene. Let us know if you want to learn more. paluch@maverickec.com

June 30, 2020 — Nicor Filing Suspended

November 5, 2020 — Staff / Intervenor Direct Testimony

December 11, 2020 — Nicor Rebuttal Testimony

January 14, 2021 — Staff / Intervenor Rebuttal Testimony

January 29, 2021 — Nicor Surrebuttal Testimony

February 9-10, 2021 — Evidentiary Hearings

March 3, 2021 — Initial Briefs

March 12, 2021 — Reply Briefs

March 17, 2021 — Draft Orders / Position Statements

April 7, 2021 — Administrative Law Judges’ Proposed Order

April 21, 2021 — Briefs on Exceptions

April 28, 2021 — Reply Briefs on Exceptions

May 21, 2021 — Tariff changes to be approved by ICC

May 1, 2022 — Tariff changes to go in effect

NEU Meeting 11-12-2020

Hi Everyone:

We hope you and your family are staying healthy under the current COVID-19 situation.

Since most NEU members are still working from home and in person meeting are not possible, we have scheduled a NEU Webinar for Thursday, November 12, 2020 from 9:30 AM to 11:00 AM. Our objective is to update you on the following important issues:

- Imminent Risk of Legislative & Regulatory Rate Hikes:

- Costly Energy Legislation — A revised, even more expensive Clean Energy Jobs Act is being pushed for Veto Session, which starts November 17;

- ComEd Rate Increases — ComEd has filed its Rate Design Investigation and proposed double-digit rate increases for large customers; and

- NICOR Storage Restraints & Penalties — Staff and intervenor testimony is to be filed on November 5.

- Energy Markets Outlook:

- Winter natural gas market supply and demand situation.

Mark your calendar and plan to participate. Russ Paluch will be emailing a GoTo meeting invite with the login details shortly.

I have also attached the October NEU Regulatory and Energy Price Bulletin. The bulletin contains an overview of ComEd’s 2020 Rate Design Investigation filing with the Illinois Commerce Commission.

Contact Russ for more info: paluch@maverickec.com

NICOR Files Proposed Changes to Customer Transportation and Storage Tariffs

Natural gas bills may be jumping for some customers if the Illinois Commerce Commission (“ICC”) approves changes that NICOR recently proposed to its transportation storage tariffs. NICOR’s proposed changes would significantly change the way customers manage their daily and monthly nominations and storage balances. Under NICOR’s proposal, there would be monthly mandated minimum and maximum storage level requirements, and all out-of-tolerance storage volumes would be cashed-out at a minimum 15% price premium.

The ICC has suspended those tariffs and initiated a proceeding (ICC Docket No. 20-0606) to determine whether NICOR’s proposal is just and reasonable but there is not yet a schedule for parties to present testimony and arguments regarding the proposal. While we are still analyzing the proposed changes to determine the full cost impact, it is clear that there would be substantial cost impacts for customers whose daily or monthly usage fluctuates significantly.

Study Background

This issue was initially raised in NICOR’s 2017 rate case (ICC Docket No. 17-0124). In response to a request that NICOR more accurately allocate its “customer care costs” to those customers who do not purchase the natural gas commodity from the utility, NICOR said the bigger issue was whether the storage costs were accurately allocated, given the way in which those customers use the storage system. The ICC agreed with NICOR; not only did the ICC refuse to allocate “customer care costs,” it ordered NICOR to prepare a storage study assessing the implications of how transportation customers and Customer Select suppliers use storage.

The storage study, which was presented for informational purposes in NICOR’s 2018 rate case (ICC Docket No. 18-1775), concluded that transportation customers and Customer Select suppliers use NICOR’s eight aquifer storage facilities in a manner that negatively impacts the short and long-term reliability of those facilities. This conclusion was made even though these customers and suppliers comply with NICOR’s current ICC-approved tariffs and practices. The study reported that transportation customers’ current patterns of storage utilization conflict with optimal storage cycling needed to sustain the operational integrity of the aquifer fields.

NICOR did not recommend any changes to its transportation service or storage services in the 2018 rate case, but instead suggested that it would file a separate proceeding to address this issue. In its Final Order, the ICC ordered NICOR to propose revenue-neutral tariff changes to address the problems NICOR claimed to identify in its study.

OVERVIEW OF NICOR’S PROPOSED CHANGES

Significant changes proposed by NICOR are:

- Rider 25, under which NICOR provides 100% standby service would be eliminated. These customers would need to switch to either sales service or another transportation service tariff.

- All transportation customers would be allocated 30 days of Storage Banking Service. There would be no option to select less than 30 days or purchase additional storage.

- There would be new daily storage minimum and maximum storage limits for each customer. Volumes outside the daily limits would be cashed-out. This means that every day, the customer would either buy additional gas or sell the excess volumes.

- There would be new monthly storage minimum and maximum storage limits for each customer. The limits proposed by NICOR would require customers to recycle their storage every year within a 90% to 10% monthly range. For example, NICOR is proposing that end-of-month storage for March and April not to exceed 10% of total storage volume; the maximum amount in storage at the end of January would be 45%.

Volumes in storage outside the monthly limits would be cashed-out. This means the customer would either buy additional gas or sell the excess volumes.

- Cash-out volumes (buy or sell), would be priced under a tiered level. For example, under Tier 1, the cash-out price would be adjusted by 15%; that is, the price would be15% higher if buying, and 15% lower if selling. The larger the out-of-tolerance percentage, the greater the price penalty. NICOR’s proposed tiers and cash-out prices are:

| Tier Level | Tolerance Level | Cash-Out Price per Therm |

| Tier 1: | -10% and +5 | 85% or 115% in index price |

| Tier 2: | <-20% to <-10% and >+5%to +10% | 60% or 140% of index price |

| Tier 3: | <-20% and >+10 | Index minus $6 or index +$6 |

The index price would be either the lower (sell) or higher (buy) of NICOR’s gas charge and Gas Daily’s daily Chicago city-gate price.

The proposed Tier 3 tolerance level of <-20% and >+10 would be a very expensive cash-out if the ICC adopts the additional $6.00 per therm penalty. Even if a customer were to pay the $6 per tolerance penalty, likely NICOR would not incur a $6 per therm charge from its pipeline suppliers.

- It does not appear that NICOR would be making any significant changes to Critical Day withdrawal or injection rules. However, it is uncertain how these rules would interact with the new daily and monthly storage restrictions.

- NICOR has proposed a new System Balancing Charge (“SBC”) for all transportation customers. It is unclear how much this charge would be.

NEXT STEPS

We are continuing to analyze the filing and determine what the cost impact would be for commercial and industrial customers, but it is clear that the daily usage and storage management would hinder a customer’s ability to effectively manage its monthly storage, especially if they have usage that can fluctuate significantly.

We will provide another update shortly, along with a notice of another NEU webinar, during which we will provide an update on this issue and other regulatory topics that could be impacting your bottom line. In the meantime, please feel free to email or call us if you may be interested in getting involved in this proceeding.

Thanks,

| Brad Fults/Chuck Drake Progressive Energy Solutions (763) 424-2377 | Russ Paluch Maverick Energy Consulting (630) 470-9176 | Chris Townsend CJT Energy Law, LLC (312) 286-0311 |

ABOUT THE NORTHERN ILLINOIS ENERGY USERS

| WHY SHOULD YOUR COMPANY PARTICIPATE? Your company or organization should be an NEU member if you would like to: •Make money in the rapidly-changing energy markets; •Save money on energy costs; •Make more effective energy procurement and management decisions; •Develop a better understanding of best practices to manage your energy costs; •Avoid future energy cost increases; •Be at the forefront of unbiased energy news and issues affecting your business; •Understand best practices on managing your business’ energy costs; •Keep senior management informed of energy issues affecting your business; •Be proactive in your approach to energy rather than reactive to market changes; and •Advocate effectively for energy policies that benefit you. | NEU educates energy users in Northern Illinois on energy topics including: • Energy markets and pricing; • Energy use best practices, current energy news; • Energy cost saving strategies; and • Opportunities to assist in shaping local and national energy policy. NEU holds regular meetings and sponsors periodic seminars on energy topics to keep its members abreast of the latest developments in the energy industry. NEU’s expert staff helps members understand complicated issues such as customer choice, renewable energy programs, distributed energy generation opportunities, rate design changes, and other complicated energy issues. NEU analyzes the status of the market and annually develops a business plan to provide members with important information, anticipating emerging energy issues in the following topic areas: legislative, regulatory, commodity pricing, products, energy efficiency, renewable energy, and utility tariffs. NEU’s annual business plan is a helpful guide to its members’ business cost planning efforts as it highlights expected energy costs in the near and long term as well as potential cost increases or decreases on the horizon. CJT Energy Law distributes the “Energy News Highlights” newsletter weekly to NEU members, providing important news on current topics and current energy pricing information. NEU also releases other important materials periodically via email or at its meetings, summarizing specific regulatory issues, analyzing utility rates, prices, tariff changes, and providing other pertinent information. In addition, the NEU website http://bit.ly/northernilenergy offers participants immediate access to useful and timely information such as breaking news, pricing updates, special reports, meeting notices, and past publications. As necessary, NEU convenes conference calls focusing on urgent market developments, upcoming legislative changes or initiatives, and legal and regulatory issues. |

Nicor Proposed Rate Case ICC Docket No. 20-0606

Revenue Neutral to Nicor – NOT to Large Customers

Nicor Rate Design History

- Transportation rates established in 1980’s

- Storage allocated as part of Nicor’s customer choice program

- In 2018 rate case, suppliers

questioned Nicor’s “customer care costs”

- All call center costs paid for by all customers

- Nicor said bigger issue is the

way in which

choice customers use storage

- ICC directed Nicor to study the storage issue

- In 2019 rate case, Nicor

presented study results

- Claimed transportation customer misusing

- ICC directed to present proposal by 6.30.20

How Commercial and Industrial Customers will be impacted:

- New Operational Restrictions

- Daily Balancing Restrictions

- Monthly Balancing Restrictions

- Mandated injections and withdrawals

- Mandated Storage Capacity – 30 Days

- New Costs

- System Balancing Charge (SBC)

- Potential for substantial penalties

- Daily Pricing will become extremely volatile/unpredictable

- May force suppliers to change operations and/or pricing

NICOR Rate Case Schedule

- June 30, 2020 — Nicor Filing Suspended

- November 5, 2020 — Staff / Intervenor Direct Testimony

- December 11, 2020 — Nicor Rebuttal Testimony

- January 14, 2021 — Staff / Intervenor Rebuttal Testimony

- January 29, 2021 — Nicor Surrebuttal Testimony

- February 9-10, 2021 — Evidentiary Hearings

- March 3, 2021 — Initial Briefs

- March 12, 2021 — Reply Briefs

- March 17, 2021 — Draft Orders / Position Statements

- April 7, 2021 — Administrative Law Judges’ Proposed Order

- April 21, 2021 — Briefs on Exceptions

- April 28, 2021 — Reply Briefs on Exceptions

- May 21, 2021 — Tariff changes to be approved by ICC

- May 1, 2022 — Tariff changes to go in effect

WHAT CAN BE DONE?

- Get informed about these changes

- Get involved and advocate!

- Get prepared for a different market reality

NICOR PROPOSED SYSTEM BALANCING CHARGE

Sherwood Direct Ex. 1.0, page 21

All transportation customers will pay a new System Balancing Charge (“SBC”), a gas cost recovery charge that allocates a portion of pipeline storage and transportation costs.

Language in Rider 15 – Customer Select (Applicable to Rates 1, 4, and 5)

Charges.

The rates for service hereunder shall be those of the Customer’s companion rate, excluding Factor GC of Rider 6, Gas Supply Cost. In place of Factor GC, the Customer shall be charged a Balancing and Storage Adjustment which shall be the sum of the following: (1) Transportation Service Adjustment (TSA); (2) Storage Service Cost Recovery (SSCR); and (3) Customer Select Balancing Charge (CSBC) multiplied by the Customer’s total use in the billing period, each such component as determined in Rider 6, Gas Supply Cost. The CBSC will be replaced with the Storage Balancing Charge (SBC) per Rider 6 as of May 1, 2022. Additionally, the Customer shall receive a Transportation Service Credit (TSC) consisting of the sum of: (1) a 0.04 cent per therm storage withdrawal adjustment credit, and (2) a 0.26 cent per therm credit for gas in storage, multiplied by the Customer’s total use in the billing period. In the event that the Customer’s Supplier does not provide the Company the required firm supply affidavit by November 1 of each year, as required under Rider 16 – Supplier Aggregation Service, the Company shall charge the Customer the Company’s Non Commodity Gas Cost (NCGC), as filed from time to time as part of Rider 6, Gas Supply Cost, in place of the CSBC, from November 1 through March 31.

In Rider 6, Gas Supply Cost, Exhibit 2.2, Page 31

SBC System Balancing Charge – Primarily a non-commodity related, per therm, gas cost recovery mechanism applied to all deliveries or estimated deliveries of gas to the Customer’s facilities under the provisions of Rate 74, Rate 75, Rate 76, Rate 77 and Rider 15, Customer Select. This charge is the usage level based counterpart to the NCGC, and excludes firm transportation costs for which the Supplier is directly responsible. Revenues arising through the application of this charge will be credited to the NCGC. This charge replaces the CSBC as of May 1, 2022.

Maverick Energy

Maverick Energy